south dakota vehicle sales tax calculator

If you are unsure call any local car dealership and ask for the tax rate. One field heading that incorporates the term Date.

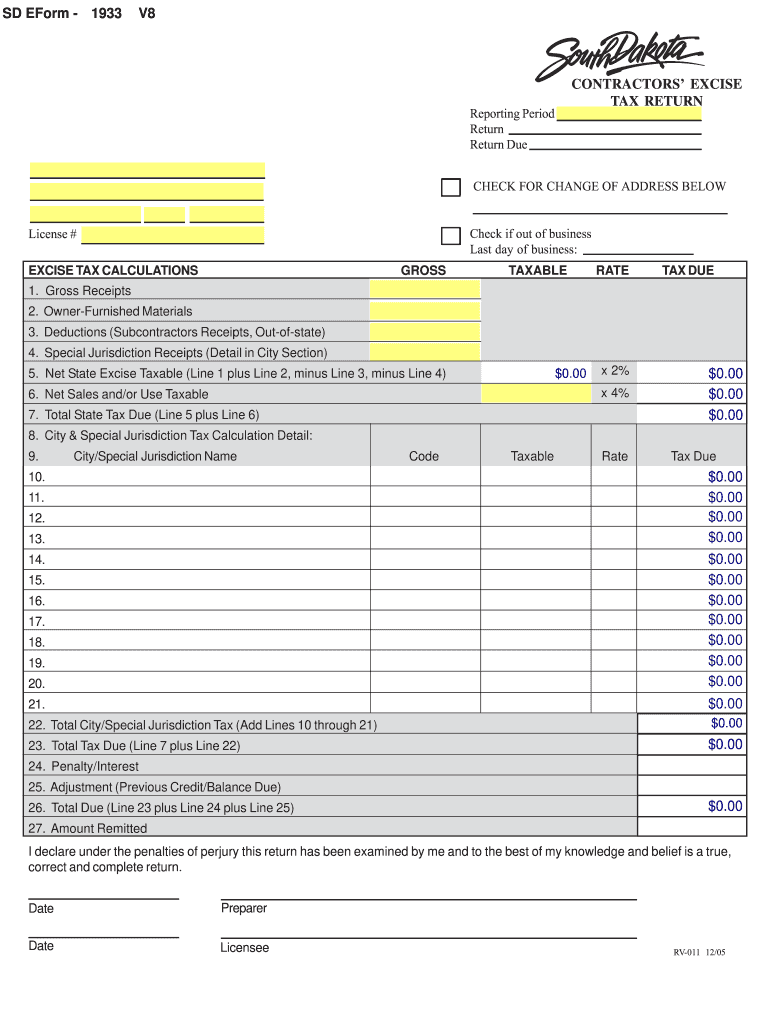

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out Sign Online Dochub

South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including.

. All car sales in South Dakota are subject to the 4 statewide sales tax. Rate search goes back to 2005. In addition to taxes car.

Just enter the five-digit zip. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. South Dakota has a 45 statewide sales tax rate.

Counties are allowed to impose an administrative fee for out-of-state and resident applicants titling motor vehicles entirely by mail. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. For more information on excise.

Average Local State Sales Tax. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. South Dakota State Sales Tax.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. All car sales in South Dakota are subject to the 4 statewide sales tax. They may also impose a 1 municipal gross.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Maximum Local Sales Tax. The highest sales tax is in Roslyn with a.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Your household income location filing status and number of personal exemptions. The vehicle is exempt from motor vehicle excise tax under.

South Dakota has a 45 statewide sales tax rate. The Motor Vehicle Division provides and maintains your motor vehicle records. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

Municipalities may impose a general municipal sales tax rate of up to 2. Find your South Dakota combined state and local tax rate. Tax and Tags Calculator.

Maximum Possible Sales Tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The state sales tax rate for South Dakota is 45.

Mobile Manufactured homes are subject to the 4 initial. This takes into account the rates on the state level county level city level and special level. The South Dakota vehicle registration.

If you make 70000 a year living in the region of south dakota usa you will be taxed 8387. Maximum Possible Sales Tax. South Dakota State Sales Tax.

The Lead South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Lead South Dakota in the USA using average Sales Tax. The South Dakota Department of Revenue administers these taxes. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Maximum Possible Sales Tax. Review and renew your vehicle registrationdecals and license plates. The average cumulative sales tax rate in the state of South Dakota is 523.

Our online services allow you to. Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. Average Local State Sales Tax.

For vehicles that are being rented or leased see see taxation of leases and rentals. Auto sales tax and the cost of a new car tag are major factors in any tax title and. The county the vehicle is registered in.

Tax and Tags Calculator. One field heading labeled Address2 used for additional address information. Maximum Local Sales Tax.

Different areas have varying additional sales taxes as well.

Rachel Hearn Rache1ynne Twitter

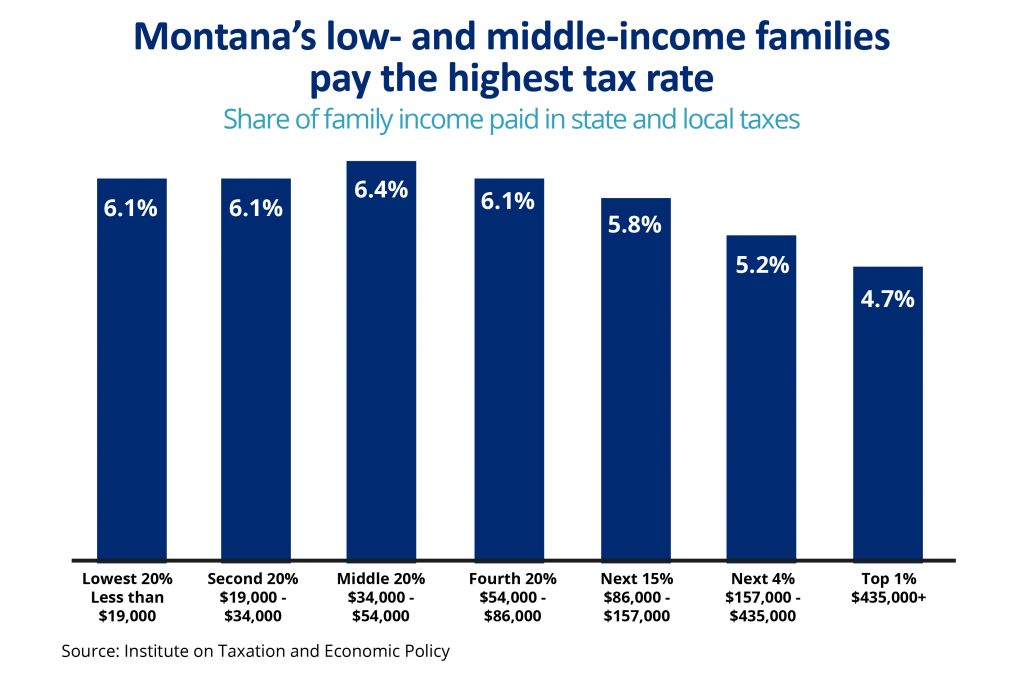

Problems With A Statewide Sales Tax Montana Needs To Help Not Hurt Families Montana Budget Policy Center

Nj Car Sales Tax Everything You Need To Know

2012 2022 Form Sd Mv 608 Fill Online Printable Fillable Blank Pdffiller

Taxes And Spending In Nebraska

Sales Tax Definition How It Works How To Calculate It Bankrate

Vehicle Registration Cost Calculator South Dakota

Sales Taxes In The United States Wikipedia

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

North Dakota Sales Tax Handbook 2022

Understanding California S Sales Tax

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What New Car Fees Should You Pay Edmunds

10 Best States For Lowest Taxes Moneygeek Com

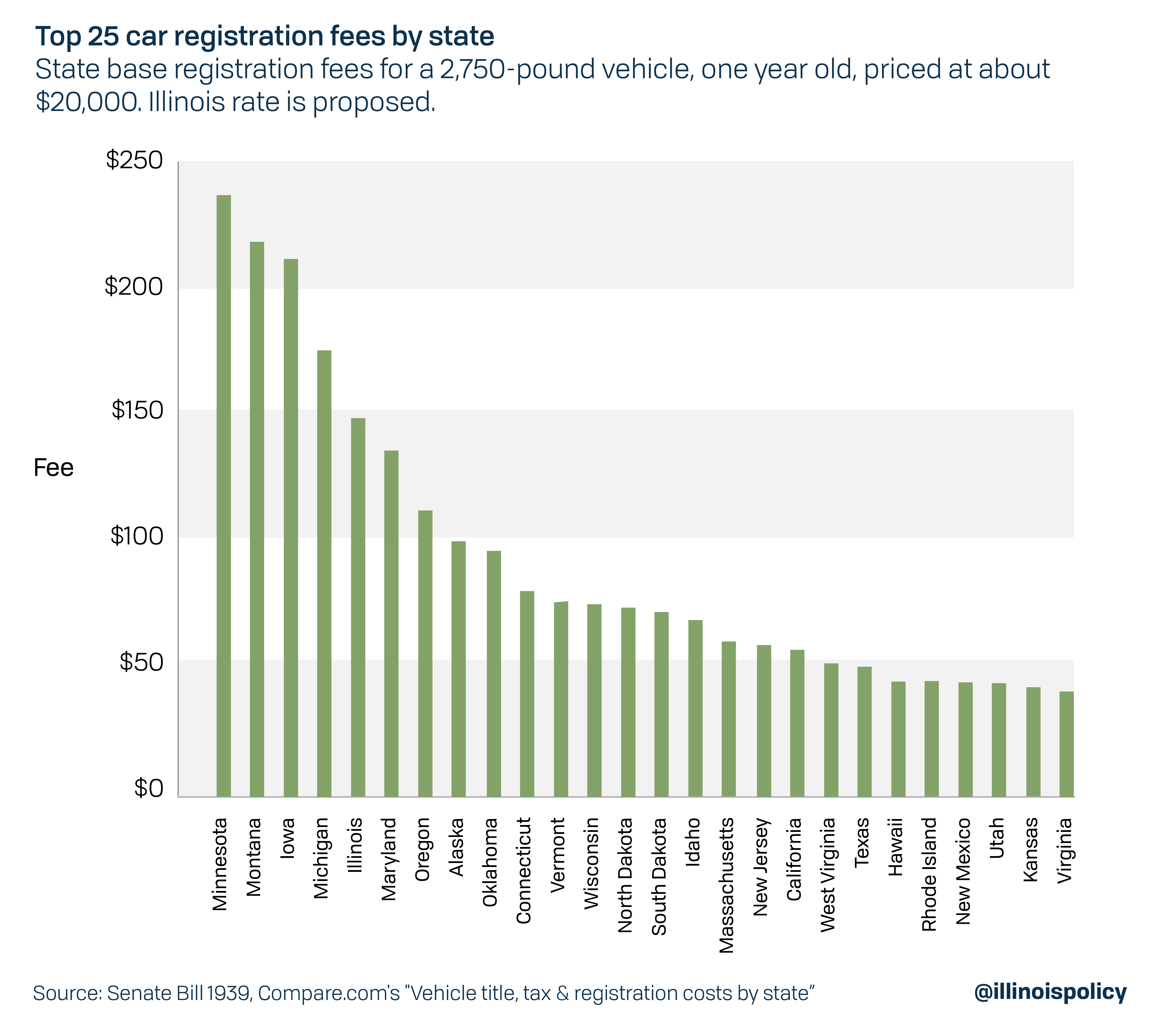

Illinois License Plate Sticker Among Most Expensive In The Nation

Sales Use Tax South Dakota Department Of Revenue